50 Ways to Love Your Lever - Part 1

How to leverage force multipliers that help you have greater impact.

What is a lever? It’s easy, really. A lever is one of the simplest kinds of machine you can make.

lev·er, /ˈlevər,ˈlēvər/ :

noun rigid bar resting on a pivot, used to help move a heavy or firmly fixed load with one end when pressure is applied to the other.

You may pronounce it so that it rhymes with “clever” or you can pronounce it so it sounds like “cleaver” — I assure you, nobody cares.

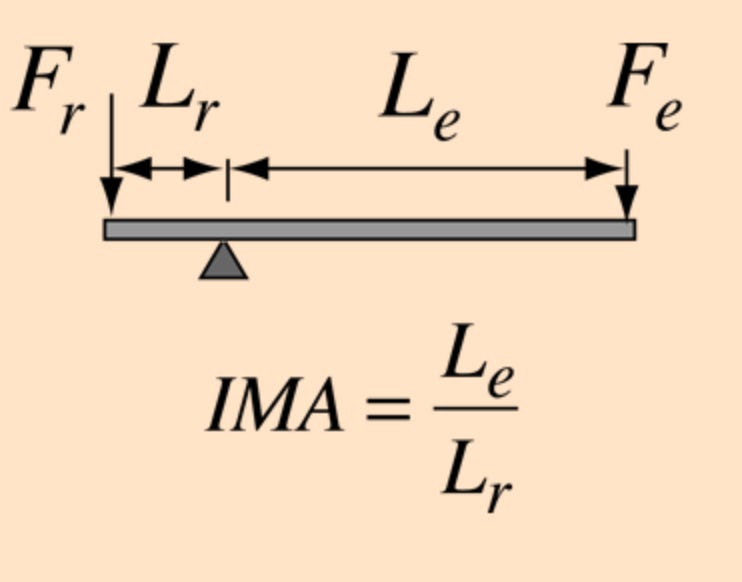

Here’s the mathematical formula for leverage, which nobody cares about either:

Levers allow the casual and apparent violation of the law of conservation of energy, which says that the amount of energy in a system is constant over time. I am not a lawyer but my understanding is that this particular law applies everywhere — all 50 US states AND the District of Columbia.

Levers seem to break this law, because you can accomplish a large task (energy out) while applying a much smaller amount of force (energy in.)

The loophole (there’s always one!) is that the input force is applied over a longer distance than the output force. Less force over a longer distance (the distance between the handles on your bolt cutters) equals more force over a shorter distance (the jaws of device.)

Next step: profit!

Levers at Work

The term lever has several interesting meanings at work. In business, product managers and business strategy folks look for levers that drive growth. That might sound like this:

We can’t gain much more market share than we already have. Our best lever for growth is launching new products to attract new customer segments.

Management often disagrees about which levers are most important at any given moment.

The marketing team might get frustrated that they’re not being given the budget they want to acquire customers, while management understands that there’s greater leverage in spending that same dollar on the development of new products.

Smart managers are constantly evaluating and optimizing how resources are applied to different priorities. They’re looking for the way to best leverage their investment — critically evaluating opportunities that are more likely to “move the needle” and move it farthest for the business.

I’ve noticed that leaders often skip over this explanation of why they’ve made the decisions they have, avoiding the use of scientific concepts like leverage even when the mathematics are on their side.

Sometimes I wonder if they think we’re not smart enough to understand that kind of thinking. But I know they’re wrong, because you’re still here with me!

Great job! Don’t stop now.

Financial Leverage

Leverage has interesting meanings related to finance and business operations. In the context of finance, leverage is quite an exciting thing, and also often very bad for you. Isn’t everything?

Leverage occurs when you borrow money to invest. The most common application is in a home mortgage, which at one time allowed you to leverage a down payment of as low as $5,000 to buy a $100,000 house. This is no longer possible, and you’re more likely to need $200,000 to buy a $1,000,000 home that was recently on fire.

Entrepreneurs use leverage copiously, and sometimes it turns out just fine.

Imagine a business selling artisanal ball bearings that buys bearings from artisans for $10 and sells them for $20. Their margin (or profit) is 100%.

Imagine that the company borrows the $10 to purchase a bearing, and pays $2 in interest for the loan. They buy the same bearing for $10, and sell the same bearing for $20, then pay the lender back $10 plus the $2 in interest.

In this leverage scenario, the company invested $2 to make $8 — that works out to a 600% profit! Even at 20% interest, using leverage makes the company six times more profitable, and interest rates are typically much lower than that.

I have glossed over a lot of the dangers inherent to leverage. Anything that sounds this good always comes with risk, and borrowing to maximize your investment should not be attempted by anyone who cannot tolerate the risk of losing it all.

Leverage is fundamental market force that drives many companies to seek extraordinarily high growth rates at the behest of risk-addicted investors. This drives them to take risks that could only be described as spectacularly stupid as measured from the perspective of a lay person, like for example hiring so many people so quickly that you can’t even locate them properly when it comes time to lay them off.

In a nutshell, leverage is the essential ingredient about everything that is great, and everything that is terrible, about capitalism.

Operating Leverage

Operating leverage is mostly unrelated to that other nasty business, and it is my favorite kind. I find it fascinating to think about how operating leverage affects different businesses.

In simple terms, operating leverage describes the ability of a company to increase profits by increasing sales. It seems obvious that one leads to the other, but that’s not really true.

Take for example a consulting firm or creative agency. They have relatively low fixed costs — no inventory, warehouses, or robots (for now.) They have offices, copiers, and servers — costs that remain remain fairly stable as the company grows. Eventually they will rise if the company gets much bigger, but they do not grow incrementally in direct relation to sales.

Variable costs are where the action is. Agencies have to hire more people to do more work when they sell it. Those people need salaries, iPhones, health insurance, wellness coaches, puffy vests with the company logo on them, etc. These costs increase proportionally as revenue grows.

This company has a high proportion of variable costs and therefore low operating leverage.

The highest operating leverage, and often the most profitable companies, have costs that rise much slower than revenue. This is famously the case for so-called “software as a service” (SAAS) companies, marketplaces for virtual goods, and most cloud things. This is why most companies were and many still are trying to become one.

Most very profitable businesses have a high ratio of fixed to variable costs, meaning they are capable of selling much more without spending drastically more. They have great operating leverage.

If you’re looking for projects that will have the best operating leverage (and you should) one way to do that is to find ways to enable the company to sell more without having to spend more. A great way to do that is to sell more to your current customers, because it costs less than attracting new customers.

Subscription businesses eventually become obsessed with retaining their customers, even more than obtaining new ones, because the cost of retaining revenue is higher than selling new customers. That’s why you see the aggressive retention tactics of subscription providers like cell phone companies.

Levers Forever

I have a particular way of thinking about the operational priorities of businesses that I’ve developed as I gained a greater understanding of how leverage works.

Most businesses have a customer lifecycle that is in some sense repetitive. Customer walks in the door, orders a drink, collects their beverage and walks out. Client signs an agreement, we have a kickoff meeting, we spend one month figuring out what to build for them, then three months building the thing. Click Add to Cart → Click Checkout → Payment & Shipping → 💵.

Lather, rinse, repeat.

Well-run companies get good at measuring and optimizing this process, and all the little micro-processes that occur inside of it.

For example, we can count the days or weeks between the time that we first make contact with a customer, and the time we finalize their order. This is called the “the sales cycle.”

If the average sales cycle is 24 days, but we see it was 22 days last quarter, and 20 days in the quarter before that, we can say with mathematical certainty that this company will eventually fail. Revenue delayed is revenue denied, and this is why you often get high-pressure sales tactics for big ticket items.

Increasingly, high-pressure tactics are rejected by customers and companies look for different ways to accelerate the sales cycle. Any mechanism that reduces complexity in a big sale is an investment in shortening the sales cycle. The next time you are involved in a big purchase, you’ll notice at least one and probably several innovations, from online car configurators to digital signatures.

If you can find opportunities to streamline or improve the most repeated processes in your business, you’re selecting highly leveraged projects to invest in. The leverage comes from the fact that a single small but important change made once can be magnified over time and repetition.

For example, a change that reduces the sales cycle by a few days or weeks for an enterprise software company could easily be measured in the millions of dollars of ROI. This is why electronic signature systems are so expensive — they predictably shave time off the sales cycle, which is like money in bank.

There’s some great writing and infographics about this here.

Ever More Clever, Any Lever Whatsoever

Okay, that was a lot of business bullshit for one day. In Part 2 of this article, I’ll talk about how I think about making leveraged decisions that affect people at work.

Why is this important? Managers are responsible for assigning their teams according to priorities that seek the greatest impact. They’re happiest when there’s a good “why” behind those priorities, and teams are happier when they understand and achieve an opportunity to have an impact that’s greater than they could achieve on their own.

This has ramifications for every aspect of a people manager’s job, especially in recruiting, defining job roles and responsibilities, matching tasks to teammates, and more.

When my time is being used in a productive, meaningful way, I feel more satisfied and less stabby — don’t you? If I’m assigned to do work that feels boring and repetitive, but that could be improved if was approached with some higher-level systemic thinking that someone above my pay grade has not been bothered to perform, I will feel sad and probably write a long and disturbing review on Glassdoor.

Nobody wants that! Managers who are good at identifying the most leveraged opportunities for their teams are going to give those teams an opportunity to feel the same sense of productivity and meaning that they themselves enjoy as leaders. That’s why most of us got into this business, and I like the idea that it’s up to us to help our teams feel that same sensation of the magnification of your effort that comes from working smarter as part of a team.

Until then, I’d love to hear how your business finds opportunities to use leverage in growing and improving. I am especially interested in whether your leaders do a good job of communicating these reasons to your teams. Please leave a comment, or just hit reply and let me know your thoughts.